Dental Loans & Financing 101 For Dental Work

Is it ever a good idea to take out a personal loan for dental work? It depends on the “what” and “why” of the treatment you’re getting. A personal loan for dental work can mean life-changing opportunities and improved quality of life. Especially if you’re missing most of your teeth, suffered from a traumatic injury or periodontal disease, or are extremely self-conscious about your smile. Dental financing with a personal loan makes it possible to go ahead and schedule your treatment without trying to spend months or years saving up to pay for it. With dental loans, you’re able to complete those treatments to enjoy their benefits of them immediately.

What Are Dental Loans?

Dental loans allow you to make your dental care expenses more accessible. Instead of having to pay the full price outright, you’re able to section it off into more manageable payments every month.

You don’t have to look far to find lending institutions for dental loans. Some companies will allow you to borrow up to $40,000 in loans to cover major dental procedures or surgery. However, most people only take out $5,000-$10,000 dental loans for things like tooth replacement, oral surgery, or smile makeovers. You’ve got a lot of wiggle room to work with.

If you’re thinking, “Who would take out a dental loan for thousands of dollars?” the answer is, a lot of people. What are some of the things you use every day? Your teeth and your car. People have no problem taking out loans for a new car every several years. A dental loan isn’t all that different from automobile financing, especially when you think about how much you rely on your teeth.

What Can I Use a Dental Loan For?

Anything. Yes, anything. You can get dental loans for veneers, dental implants, wisdom tooth removal, root canals, braces or crowns, you name it. Most people use their dental loans to pay for issues related to pain, when emergency treatment is required, or more emotionally driven like a smile makeover.

Dental financing with personal loans is good for medium to large dental procedures since you can get a larger loan amount. If you need treatment and can’t or don’t want to wait another day to start the process, a dental loan puts you in the driver’s seat to better oral health.

Investing in dental care can pay off in more ways than one. Some studies even show that people with attractive teeth tend to earn higher salaries and have more friends because they seem extra friendly!

Should You Apply For A Dental Loan?

If you’re on the fence about whether or not to apply for a dental loan, here are some common examples of when it’s a good idea:

- You don’t have dental insurance, but you need dental work

- The dental treatment you need is fairly extensive

- You’re in pain or experiencing a dental emergency where treatment needs are urgent

- There is an elective procedure—such as veneers or Invisalign—that will tremendously improve your self-esteem and social relationships

- The treatment you want to finance will be physically and emotionally life-changing (such as All-on-4 dental implants.)

Usually, dentists give you a couple of different options when it comes to your treatment choices. Such as extracting a tooth and leaving that area alone, getting a root canal and crown, or removing the tooth and placing a dental implant. The extraction vs. root canal debate. The fastest and cheapest option is to pull the tooth and not do anything else. But long term, changes in your mouth will lead to additional expenses and treatment needs. Financially, the smarter choice would be to restore the tooth or immediately replace it, but both of those options cost more; if they aren’t in your budget, taking out a loan to pay for them today will actually save you money in the future.

How to Get a Dental Loan

Dental loan providers are easy to find online, but you don’t necessarily need a “dental” loan per se. You can also go to your local bank to take out a private loan to pay for dental work. Some dental loans come in the form of a credit card financing platform, where you pay for the treatment with your account and then work to pay off the balance. If you’re taking out a dental loan just for dental treatment, you’ll want to have your treatment plan from your dentist so that you know exactly how much money to borrow.

What to Consider When Choosing a Dental Loan

Are you on the fence trying to decide whether you need a dental loan vs. a dental credit card? Here are some things you’ll want to consider before borrowing money from a bank to pay for dental treatment:

1. Funding Time

How quickly do you need to schedule your dental treatment? Is it something urgent, where the procedure needs to happen immediately? If so, you may not have time to take out a personal dental loan. But if it’s a treatment that can wait a couple of weeks, you usually have time to work out the details with your bank and have the loan fully funded before your scheduled appointment. In contrast, dental credit cards can fund within the hour (making them great for emergencies.)

2. Interest Rates

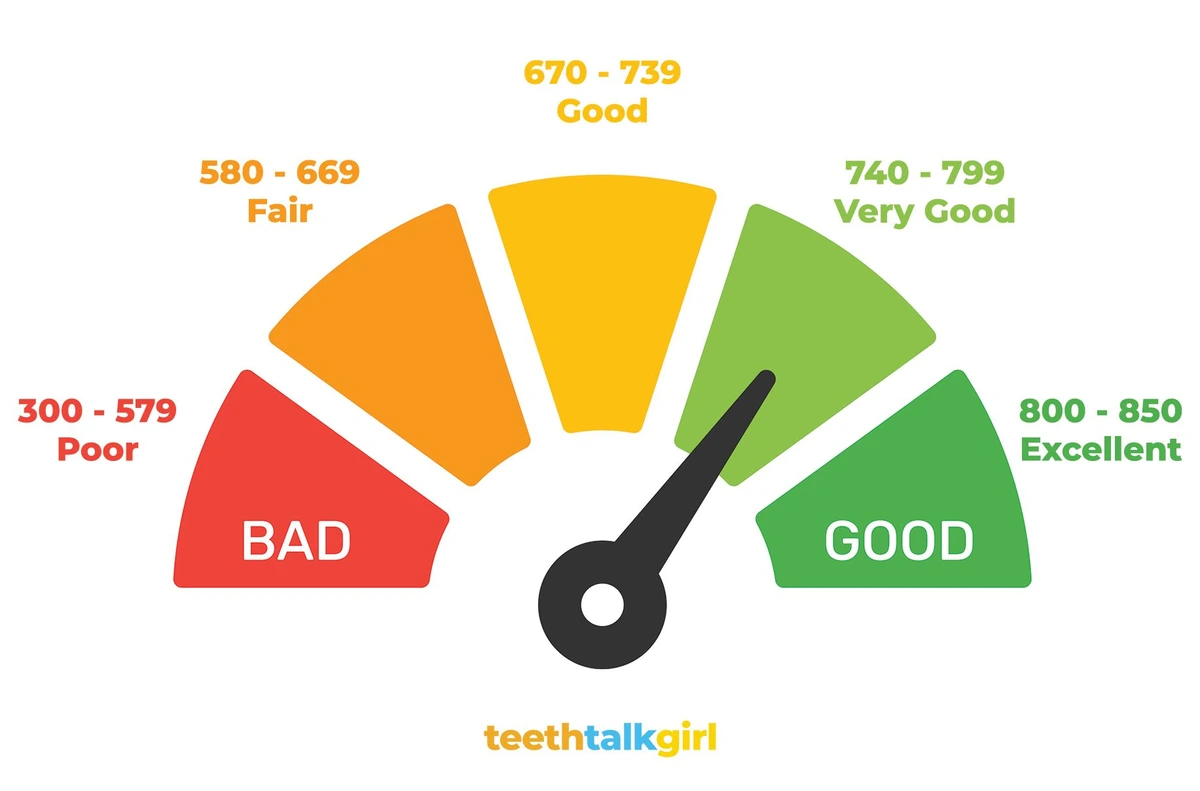

Your interest rate options are extremely flexible if you’re taking out a personal loan for dental work. Depending on your credit score, some people can get loans with as little as 3.99% APR, while others have interest rates as high as 36%. The average $10,000 personal loan from a national bank might have an APR as low as 5.74%, which is about a third or less of what you’ll see on dental credit cards. If you’re planning a major smile makeover or reconstructive surgery, a dental loan and an excellent credit score will save you more money over the long term.

3. Credit Score Requirements

Some types of dental loans and lenders don’t require credit checks, while others do. Your credit score will affect whether or not you qualify for lending and the type of interest rate they give you on your dental loan. Once you know your loan amount for your dental procedures, it’s not a bad idea to shop your options or talk to different banks/lenders to see what you can prequalify for (prequalifying will not affect your credit score.)

4. Term Length

Loan terms are important. How long do you have to pay back the balance? 12 months no interest? Five years fixed interest? How do those payback options work with your current income and monthly budget? Compare it to your credit card or car monthly payment if that helps you see the big picture.

5. Customer Service

Read online reviews of lending platforms, loan providers, and dental credit card companies. If you see consistently low or poor reviews, it’s best to steer clear and go with another lender, otherwise, you risk penalties and hidden fees that you might have missed.

Dental Loans for Bad Credit

You might be wondering, “Should I even bother?” If you have bad credit but need dental work, the fiscally responsible thing to do is treat the dental issues now before they get worse. The longer you wait to address them, the more involved and expensive they become. It’s not a matter of “if” or “maybe,” it’s an always-happens type of thing. So, your best bet is to figure out a way to pay for care and treat the issues ASAP, even if you have to find a dental loan with bad credit.

Sometimes it can be a challenge to get a dentist loan if your credit score is less than ideal. In most cases, the easiest way to get dental financing without extremely high-interest rates is to get a private loan from your banking institution. In most cases, the interest rates a bank or credit union charges will be lower than what you would see with a 3rd party dental credit card.

Find the best loans with bad credit here!

Alternatives to Dental Loans

Loans aren’t your only dental financing option for affording oral health care. There are other accessible, affordable options for people who need a more budget-friendly way of getting their dental work completed. Some of them involve third parties, while others require thinking outside of the box or traveling a small distance away to see a different provider.

1. Dental or Medical Credit Cards

One of the best dental financing options is credit cards. This choice is an excellent way to afford your treatment without taking out dental loans. In most cases, your dental credit card will be through a lender such as CareCredit, LendingTree, or something similar. Depending on your credit score and the type of dental credit card you’re applying for, you may be able to get a 0% interest introductory period. What that means is you can pay off the balance over time before any interest rates ever kick in. Some lenders offer 0% interest for up to 6-12 months or longer. Ask about the fine print, such as deferred interest, to ensure you’re not compounding any interest or dealing with pre-payment penalties.

2. Dentists With Payment Plans

Some dentists will offer private financing options through their private practice. They might require a 25-50% down payment and a set amount each month afterward. Typically, these dentists do not advertise their payment plans, so you have to ask them about it in person. Most dentists will only offer private payment plans to patients that they have ongoing relationships with and who have never carried a balance on their accounts. If you’ve always paid your dental bill on time and have seen the same dentist for years, you’re in good shape to ask about a payment plan.

Dental savings plans help offset up to 10% to 60% off dental costs and dental procedures. Get a discount dental plan here and save!

3. Dental Schools

If you’re close to a dental college, you’re in luck. If you’re patient and don’t mind waiting on a call list or spending extra time up at the university, dental schools offer high-quality dental procedures and lower dental costs in their clinics. The key is to get in for an exam (there might be a waiting list) and treatment plan workup, then schedule with their first available student opening. Your appointment times will be longer because of supervision and grading processes, but the cost of your care will be far less than that of a private clinic.

4. Private Loans

Working with your private bank or credit union is an easy way to get approved for personal loans. You can use the loan on whatever you want, from dental work to home projects. In most cases, it’s easier to get a lower-interest personal loan from your credit union than a dental credit card if your credit history is less than perfect. Low monthly payments are required, so you can take your time paying it off.

5. Cash

Did you just get your tax return or refinance your home? If you’ve got extra cash on hand, always ask your dentist about a cash discount (even if you don’t need one.) Most offices will take a set amount (usually 5% or so) off your balance if you’re paying in full with cash at the time of service. Plus, with cash, you don’t have any extra interest rates to tack onto the amount you’re paying off.

Dental Financing with Personal Loans

Sometimes it can be a smart choice to take out a personal loan for dental work. Dental loans allow patients to get the medically necessary dental treatment they need—or something dramatic like a smile makeover—without having to put it off until later. Loans for dental work are fairly common, especially with fewer people with dental insurance. If you want something like braces, full-arch implants, or a complete set of dental veneers, you’ll probably take out some type of dental loan. When in doubt, you can always ask your dental office if they offer payment plans or loans and see what they have to offer!

Make your inbox smile!

Subscribe