6 Best Dental Loans for Dental Work (for 2025)

In this article, we may include products or services we think are useful for our readers. If you buy through links on this page, we may earn a small commission to help fund our mission to create more healthy smiles. Here’s our process.

Whether you’re looking for affordable cosmetic dentistry to fix a smile that you’re embarrassed of, or you simply can’t afford the cost of dental work on your current budget, financing your dental work through a loan from a dental finance company may be the perfect solution. Even people who have “good” dental insurance often find themselves taking out loans for dental work, because expensive dental procedures aren’t covered or their benefits run out. Understanding the ins and outs of dentistry loans can help you know what to look for if you’re planning on using a dental payment plan.

What Are Dental Loans?

A dental loan is a type of dental financing or payment plan option that allows you to receive dental work without having to pay any of the upfront cost. It's an option of paying for your dental procedures over time, breaking them up into more affordable chunks, so to speak.

Dental loans or personal loans are used when people need unexpected or expensive treatment, and they prefer not to (or can’t) pay for the entire amount upfront. A finance company will lend you an amount of money to cover dental costs and in return, you’ll pay them back in monthly payments until the loan is paid off.

6 Best Dental Loans For Dental Work

Dental financing for dental work can be pricey, especially if you’re getting an emergency treatment or cosmetic procedure done. For many people, dental procedures just aren’t in the budget, especially if they need to be completed on short notice. An easy solution to this problem is to take out a dental loan or a personal loan.

Taking out personal loans for dental work allows you to pay the cost back over time at a rate you can afford, rather than having to pay all at once. However, not all dentistry loan agreements are created equal. When selecting a loan, you’ll need to consider interest rates, fees, payment terms, and more to ensure you’re finding the right option for your needs. We’ve rounded up six of the best personal loan lenders for dental work on the market.

1. Upstart Personal Loans

Best for Overall Dental Loans

Upstart is unique in that they use AI and machine learning technology to assess borrower applications. They’ve found that traditional credit evaluation methods can be limiting, so their technology assesses a wider range of factors. This provides credit access to a wider range of borrowers without increasing risk.

With a minimum credit score requirement of 600, Upstart is a good option for borrowers with mid-range credit scores who might not qualify for other loans. You can even run a soft credit check for pre-approval before applying for extra peace of mind. Upstart is also unique in that dental loans range from $1,000 to $50,000, and you can choose the exact amount you need for your dental financing.

Quick Facts:

- Annual Fee: No annual fee, 0-10% origination fee

- APR: Fixed APR ranging from 6.5% to 35.99%

- Recommended Credit Score: 600+

Pros and Cons

Pros:

- Alternative approval methods: By evaluating factors beyond your credit score, Upstart is able to approve a wide range of borrowers that might struggle to get other loans.

- Pre-approval available: Upstart can run a soft credit check and give you a rate estimate before you apply.

- Loan amount: Upstart has loan amounts of $1,000 - $50,000

- Flexible payment dates: Upstart allows payments 15 days before or after your due date.

Cons:

- Limited payment terms: Borrowers can only choose from 3 or 5-year repayment plans.

- No co-signer options are available.

- High origination fees: Upstart’s origination fees can be as high as 10%, although they don’t charge annual fees.

2. American Express Personal Loan

Best For Good Credit

You may already be familiar with American Express’s credit card offerings, but their personal loans can also be very helpful if you need to get dental work done. These are a great option for borrowers who are already American Express cardholders, as loans are typically pre-approved and there’s no hard credit check. There’s also no origination fee and they can typically fund a loan in less than a week, which makes it convenient for urgent dental work.

However, American Express personal loans are only available to existing cardholders. They also aren’t particularly flexible in terms of length, payment date, and other loan terms.

Quick Facts:

- Annual Fee: No annual or origination fees, late payment fees of $39 each.

- APR: Ranges from 5.91% to 19.97%, no discounts available

- Recommended Credit Score: No minimum credit score, but must be an existing American Express cardholder.

Pros and Cons

Pros:

- Loan amount: $1,000 to $40,000

- No origination fees: Unlike many other lenders, American Express doesn’t charge any origination fees, which can save you a significant amount of money.

- Fast funding time: Most borrowers receive their money in three to five business days.

- No hard credit check: This means your credit score won’t change when you apply.

Cons:

- Only available to American Express members.

- No option to change payment date mid-term.

- No co-signers or secured loans available.

3. BadCreditLoans.com

Best for Bad Credit

Bad Credit Loans isn’t a lender and doesn’t provide unsecured loans, but it shows your loan request information to lenders and lending partners in their networks so they get the best dental loans for bad credit. Loans can vary from 90 days to 72 months and range between 5.99% and 35.99% APRs.

Quick Facts

- Loans from $500 to $10,000

- Get connected to a lender fast

- Quick funding

Pros and Cons

Pros:

- No origination fees: Bad Credit Loans doesn’t charge any fees, and is 100% free.

- Fast funding time: Most borrowers receive their money in three to five business days.

- Compare loan options: Choose the best loan options all in one place that works best for you and your credit history.

Cons:

- High APRs depending on credit score

- Non-loans offers

BadCreditLoans.com can get you the funding you need to get your dental work done. This is a good platform for people with bad credit who aren’t sure what type of loan they need and want to compare all their options.

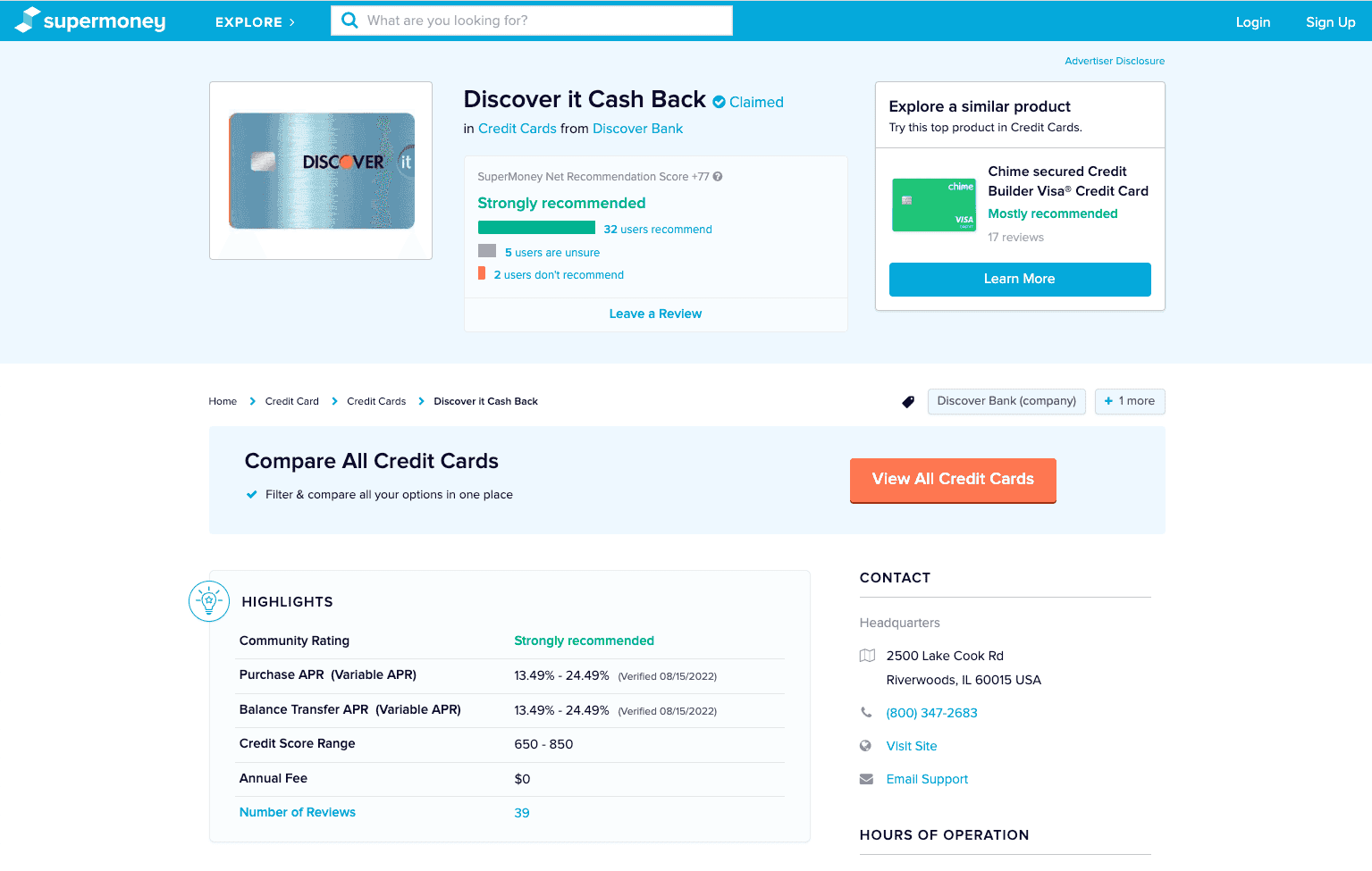

4. Discover Personal Loans

Highest Rated Personal Loan Lender

Discover is an excellent option for dental loans if you already have a stable credit score. The Discover platform offers excellent online customer support as well as reasonable APR rates. Additionally, Discover offers a unique feature where borrowers can cancel the loan and return the funds within 30 days without paying any interest.

Quick Facts:

- Annual Fees: No origination or annual fees, late payment fee of $39

- APR: Fixed APRs ranging from 6.99% to 24.99%

- Recommended Credit Score: 660+

Pros and Cons:

Pros:

- Flexible payment terms: Repayment terms range from three to seven years, and there’s no penalty for prepayment.

- No origination fees.

- Excellent customer service: Borrowers can manage their loan and view their credit score online, and loan specialists are available online at any time. You can also manage your loan using their mobile app.

Cons:

- Best for high credit scores: If you have a poor to fair credit history, you may not be approved for Discover’s personal loans.

- Strict late fees: Discover has strict payment due dates and charges a fee of $39 for all late payments.

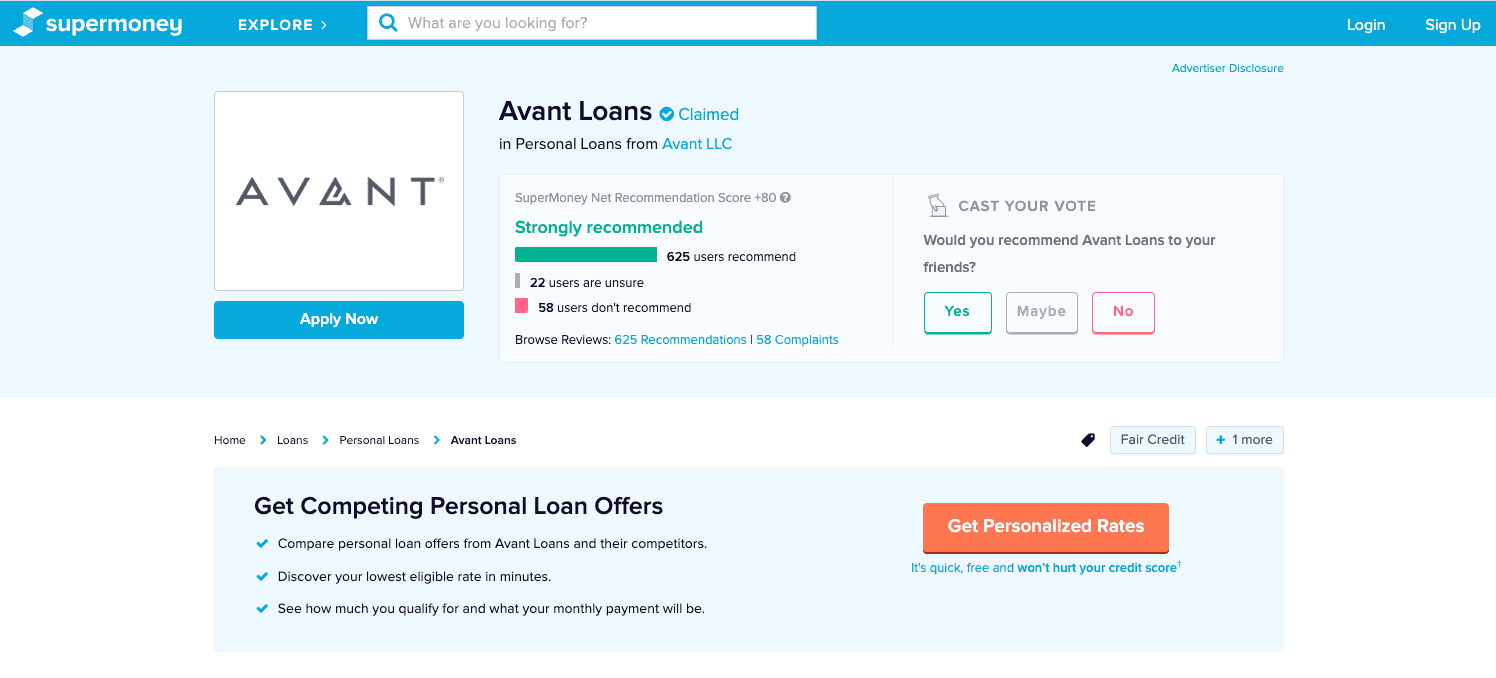

5. Avant Loans

Good Personal Loan with Fair Credit

Avant is an online lender and credit provider that is known for their flexible payment terms and reasonable eligibility requirements. Personal loan amounts range from $2,000 to $35,000 with repayment terms ranging from one to five years. Their emergency loans are a great option for anyone who needs emergency dental treatment, as they are often funded as soon as the next business day after approval.

Quick Facts:

- Annual Fee: Origination fees ranging from 0-4.75%

- APR: Fixed APR ranging from 9.95% to 35.95%

- Recommended Credit Score: 580+

Pros and Cons

Pros:

- Great for borrowers with less-than-perfect credit: You only need a minimum credit score of 580 and a minimum income of $20,000 to qualify.

- Flexible repayment terms: Repayment ranges from one to five years, and borrowers have the option to change their payment date.

- Fast funding: Emergency loans are often available within 24 hours.

Cons:

- High APR rates: While these loans are great for borrowers with poor or fair credit, borrowers with good credit can likely find better rates elsewhere.

- No co-signers or joint loans: However, Avant Loans may consider other household income or child support in addition to your personal income for approval.

6. Best Egg Personal Loans

Good For High Loan Amounts with a Fair Credit Score

Best Egg is a lender that makes it easy to get a personal loan online to finance dental work. Getting dental work can be stressful, so having personal loans you can manage online makes the process easier. Online pre-approval lets borrowers preview rates before applying, and loans are typically funded in three business days or less. Best Egg offers loans ranging from $2,000 to $50,000, with repayment terms ranging from 3 to 5 years.

Quick Facts:

- Annual Fee: Origination fees ranging from 0.99% to 8.99%

- APR: Fixed APR of 8.99% to 35.99%

- Recommended Credit Score: 600+

Pros and Cons:

Pros:

- Easy online application: Borrowers can complete the entire application process online and even get pre-approval with a soft credit check.

- Wide range of loan amounts available: Loans ranging from $2,000 to $50,000 are available, so you can borrow the right amount for your dental treatment.

Cons:

- Origination fees on all loans.

- APR rates are high for borrowers with lower credit scores.

7. LightStream

Low APR High Loan Amounts

LightStream is a lending division of Truist Bank. They are known for their competitive rates and fast approval times, and loans are available in all 50 states. Their dental loans also have flexible terms and can be used for virtually anything. These loans are best for borrowers with excellent credit, as those with poor to fair credit likely won’t be approved.

Quick Facts:

- Annual Fee: No fees

- APR: Fixed-rate APR. Discounts are available with autopay.

- Recommended Credit Score: Good to excellent credit

Pros and Cons

Pros:

- Fast funding: Most loans are funded in just one business day.

- Flexible loan terms: Loans from $5,000 to $100,000 are available with flexible repayment terms

- Low APR rates: When compared to competitors, LightStream offers very reasonable APR rates for the most qualified borrowers.

Cons:

- Best for good credit score: Borrowers with poor credit scores are unlikely to qualify.

Don’t let high treatment costs stop you from getting the dental care you need. Using a personal loan to cover your dental costs gives you the flexibility to pay over time. With so many different loans on the market, borrowers can choose an option that best suits their current financial situation.

What To Consider When Looking For A Dental Loan

There are a number of things to consider when looking for dental loans for dental work. First, you should estimate how much the total cost of your dental procedure will be. A rough estimate of the dental expenses better than nothing, but it's best to get an estimate from your dentist or find out what they charge per procedure at their office. Next, think about whether you're looking for a long-term payment plan or need short-term financing so you can make payments as you go. Would you rather pay a few payments directly to your dentist’s office, or take out a loan for dental work through a third party lender?

Dental financing companies also offer a variety of interest rates and repayment terms. For example, some offer 0% interest as long as you pay off your dentist loan within 6-18 months. Others may a low-interest dental loan with minimal amounts required each month. Your credit score can also impact whether you’re able to get a personal loan for dental work and the interest rate that’s offered. Remember most personal loan proceeds can't be used to refinancing existing debt.

When Should You Use A Dental Loan For Dental Work?

Second, it’s wise to take out a personal loan for dental work if you need treatment now but have to pay it back in smaller increments. A personal loan for dental work will give you the freedom to complete the treatment without having to wait on setting that money aside. These dentistry loans are available both through dental finance companies as well as your own personal bank or credit union.

Dental Loans vs. Credit cards: Which is Better?

The answer to this question is not as straightforward as you might want it to be. It really depends on the situation of each individual and what they're looking to accomplish. There are a few things to take into consideration when weighing the pros and cons of either option. For example, dental loans may be easier for people who have bad credit or no credit since it’s difficult to get a credit card with a reasonable interest rate.

You might be able to earn cash back or airline miles on a credit card, but a personal loan for dental work will likely have a better (lower) interest rate and loan agreement.

The Benefits Of Dental Loans

Taking out a dental loan can be an excellent way to pay for dental work in a quicker, more affordable, and flexible manner. Whether you're looking for a dental loan because your dental insurance doesn't cover the full cost of a dental implant treatment, or you’re finally splurging on braces as an adult, it’s a personal decision to make.

The biggest benefit of dental loans is that they allow you to pay for a much needed dental procedure—regardless of how expensive the dental costs are—without having to pay the total cost all at once. It can be difficult to predict exactly how much your care will cost, so most people rely on dental financing their treatment over time. Some dentistry finance companies give you up to 18 months with no interest and low monthly payments that fit into even the tightest budgets.

Can I Get A Dental Loan With Bad Credit?

It's possible to get a dental loan with bad credit, but it's more difficult to get low interest on them. Most companies will require higher interest rates and sometimes down payments to compensate for the risk that you won't be able to repay the loan. That being said, there are still lenders out there who are willing to work with people with a less than perfect credit score, so if you have bad credit, it doesn't mean you can't finance your dental work.

While getting a loan for dental work with bad credit is possible, you'll need to shop around. The best way to do so is by using a service that compares rates from multiple lenders and provides you with custom quotes based on your individual financial situation. When it comes time to actually apply for dental financing, fill out an application for a few different lenders in order to find one that offers low-interest rates and terms that fit your budget.

How Much Do Treatments Cost?

The average cost for dental treatments ranges between $1,000 and $4,000, with treatments like dental implants or porcelain veneers costing even more. Luckily, there are ways to get pricing for dental treatments that may help you better understand what you're up against. In addition to working with a trusted dentist who can explain your options and give you a price estimate, you should also consider getting a second (or third) opinion. Chances are, you’ll be able to find a dentist who is more conservatively priced because of alternative treatments you may not have considered. Some dental offices even offer dental financing options and attractive payment plans.

Dental Financing With Personal Loans

Taking out a personal loan for dental work can help you afford the treatment you need without having to wait to get it. And yes, there are dental finance companies out there who can work with you, even if your credit isn’t all that great. Talk to your dentist or your personal bank/credit union for more information.